Flexible Spending Accounts – Open Enrollment

That’s right. You can pay less in taxes and increase your take-home pay by signing up for a healthcare FSA, a dependent care FSA, or both. (Check with your HR department to learn which FSA accounts your employer is offering.)

A healthcare Flexible Spending Account (FSA) allows you to set aside money for non-reimbursed healthcare expenses on a pre-tax basis. A dependent care FSA allows you to do the same, but for dependent care expenses. As you incur eligible expenses throughout the year, you can get reimbursed with tax-free dollars from your spending account.

- 1.Let’s say you earn $3,000 a month.

- 2. That means you pay about $980 in Federal and Social Security taxes (assuming a 32.67% rate).

- 3.Now let’s say you decide to contribute 5% or $150 per month to your FSA account(s).

- 4.That drops your taxes by 5% to $931—a savings of $49 per month.

- 5. You essentially get a raise by increasing your take-home pay.

- 6.You get $588 more in your take-home pay each year! $49 x 12 = $588 a 1.6% increase

Enrollment is quick and easy. Using your healthcare and/or dependent care FSA account is even easier with a convenient debit card (if available with your plan) and secure Employee Portal and Mobile Application that lets you see your balance, view statements, and see alerts about required actions.

Here are just a few examples of qualified expenses:

Healthcare FSA

Most physician and Hospital Expenses • Allergy Treatments • Dental Work • Orthodontia • Chiropractic Fees • Glasses or Contact Lenses • Laser Eye Surgery • Mental Health Counseling • Sleep Disorder Treatments • Vaccines

Dependent Care FSA

Child (under age 13) or elderly dependent daycare inside or outside the house (no overnight or nursing home expenses) • Day Camps • Nanny

Expenses • Licensed Preschool or Daycare Expenses • Unlicensed Daycare for six or fewer children

Individual Premium FSA

COBRA Premiums • Individual disability premiums • Child Health Plus Premiums • College Health Fees

Adoption Assistance FSA

Travel Expenses • Attorney Fees • Court Costs

For a complete list of eligible expenses, please visit our website, www.proflextpa.com or consult IRS Publication 502.

Important Items to Remember

Annual Election:

Once enrolled, you may not change your annual election amount. According to IRS regulations, you may only change your elections at the beginning of each plan year unless you experience a change in your family status. A change of family status may include marriage, divorce, birth, adoption, death or a loss of spouse’s employment.

Changes in the contribution amount must be consistent with the change in your family status. For example, if you gain a dependent, you increase your contribution, if you lose a dependent, you decrease your contribution. Please contact your Human Resource Department if you experience a change in status.

Any reduction in your taxable pay for Social Security purposes may also lead to a reduction in your Social Security benefits. For most employees this reduction is insignificant compared to the value of paying lower taxes today.

The amount of money you save in taxes depends in part on the elections you have made. You should carefully estimate the total amount you elect to set aside in your account. With the “Use it or Lose It” rule, any monies taken pre-tax must be used in the plan year to pay for qualified, elected benefits or they will be forfeited. Please use the personal worksheet in this brochure to help estimate your election.

Certain plans allow for the rollover of up to $500 of unused Medical FSA funds at the end of the plan year. Funds will rollover automatically, and can be made available for use in the following plan year. Please check with your Plan Administrator for more information on whether this provision applies to your FSA Plan.

Claims Submission:

If you are filing a paper claim for the Health Care Reimbursement Account, you must first file the claim with your insurance carrier, if the service is covered under your contract. All receipts and Explanation of Benefits statements must include the date of service, services rendered and the provider and patient’s name. Cancelled checks are not acceptable in lieu of a receipt. Previous balances are also unacceptable in lieu of an itemized statement.

Dependent care receipts must include your dependent’s name and the time period you are paying. You will be provided with claim forms that must be completed and returned with your receipts. You may fax or mail your claims.

All claims must be incurred during your plan year to be eligible for reimbursement. You will have a defined period of time after the end of the plan year to submit receipts that were incurred during the plan year.

When submitting a healthcare reimbursement claim, you will be reimbursed the total amount for that claim up to the total annual plan year election amount, regardless how much is in your account at that time.

For a dependent care claim, individual health/disability premium and adoption assistance plan, you will be reimbursed the amount on your claim up to the total amount in your account at the time the claim is submitted. If the claim cannot be paid in full, the system will reimburse you as the money accumulates in your account. There is no need to resubmit your claim.

DIRECT DEPOSIT SAVES TIME!

Eliminate the hassle of manual checks and have your reimbursements deposited for you directly into your account. No more waiting for the mail or wasting time at the bank. Let us do the work for you.

Sign up for direct deposit TODAY to get your reimbursement faster. This service is FREE!

The Pro-Flex Payment Card

What is the Payment Card?

The MasterCard Debit Card is a convenient debit card that can simplify the process of paying for eligible expenses. It is an alternative to the traditional method of filing claims. You can use the card at qualifying merchant locations wherever MasterCard is accepted – from physician and dental offices to pharmacies and vision service locations.

Exactly what is the convenience of the Payment Card?

The Payment Card allows you to pay for eligible expenses at the point of service:

- Immediate access to your FSA account – you avoid paying with cash or check

- Immediate payment of the expense – you avoid waiting for a reimbursement check

Although there is no requirement for you to complete claim forms with the Payment Card, additional documentation may be required in some cases in order to meet IRS guidelines. Therefore, you must keep copies of all receipts and itemized statements (not the credit card receipt) for each purchase.

Frequently Asked Questions

Is this process paperless?

No. Although there is no requirement to complete claim forms, additional documentation may be required in some cases. Therefore, you must keep copies of all receipts and itemized statements (not credit card receipts).

What type of additional information may be required?

This includes cash register receipts for items such as hearing aid batteries or contact lens solution, bills or statements from your healthcare provider for vision or healthcare expenses and pharmacy receipts for prescription drugs. Credit card receipts are not acceptable.

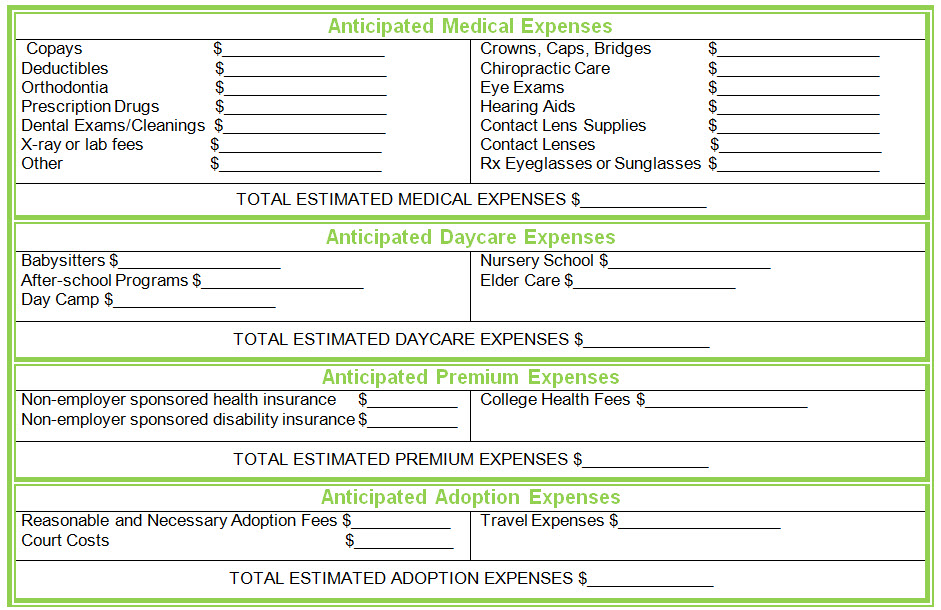

Anticipated Expenses Charts

We have designed this worksheet to help guide you in estimating your expenses for the plan year. Your final annual commitment election is based on your personal situation.

You cannot begin, suspend, increase or decrease your contribution during the plan year unless your family status changes. Changes must be made within 30 days of the qualifying event. Eligible expenses include any expenses considered deductible by the IRS for Federal income tax purposes.

Claims Reimbursement FAQs

Claims can be submitted for reimbursement for qualified expenses incurred during the plan year. Each plan allows for a “run-out” period at the end of the plan year where claims incurred during the plan year can be submitted.

(Refer to your plan summary for the “run-out” time period allowed.)

Remember that reimbursements are based on when the service is provided, not when the service is billed or paid.

How do I submit my request for reimbursement?

• Fax claim to (716) 929-2013 or toll free to 1-855-214-8987 using a claim form with service documentation

• E-mail claims to csr@proflextpa.com

• Upload your claim online at www.proflextpa.com or via our mobile app

• Mail claim to:

Pro-Flex Administrators, LLC

8321 Main Street

Williamsville, NY 14221

Whether you are faxing or mailing a claim to Pro-Flex, make sure to include all the evidence of your expense (i.e., receipts, explanation of benefits, etc.).

How does Pro-Flex Administrators, LLC reimburse me?

The quickest way to receive your money is by direct deposit to your personal checking or savings account. You can sign up for direct deposit by completing and submitting the direct deposit authorization agreement available at www.proflextpa.com, or by logging into the Employee Portal and populating your bank account information on the “Profile” tab.

You can also receive your money via check mailed to you at home. Once enrolled in direct deposit, all deposits are made via direct deposit until we are notified otherwise.

When can I enroll?

You can only enroll in the plan annually at open enrollment or when you become newly eligible. Your employer will notify you each year when it is time to enroll.

What is the maximum amount I can be reimbursed?

• Medical, dental, vision expenses will be reimbursed based on the total amount indicated on the claim request.

This amount must not exceed your total plan-year election amount.

• Dependent care, individual premium and adoption expenses will be reimbursed based on the amount indicated on the claims request up to the total amount in your account (payroll deducted) at the time the claim is received. Total amounts must not exceed your plan-year election amount and must be submitted with appropriate documentation to verify eligibility of expenses.

(Minimum check reimbursement amount is $25.oo)

How will I know the status of my account?

Each reimbursement check you receive will include an account summary. You will receive an annual statement for your account electronically, if you provide Pro-Flex with your email address.

Claims Submission

If you are filing a paper claim for the Health Care Reimbursement Account, you must first file the claim with your insurance carrier, if the service is covered under your contract. All receipts and Explanation of Benefits statements must include the date of service, services rendered and the provider and patient’s name.

Cancelled checks are not acceptable in lieu of a receipt. Previous balances are also unacceptable in lieu of an itemized statement.

All claims must be incurred during your plan year or period of coverage to be eligible for reimbursement. You will have a defined period of time (the “run out” period) after the end of the plan year to submit receipts that were incurred during the plan year.

When submitting a Health Reimbursement Account claim, you will be reimbursed the total amount for that claim up to the total available HRA Allowance.

Direct Deposit Saves Time!

Eliminate the hassle of manual checks and have your reimbursements deposited for you directly into your account. No more waiting for the mail or wasting time at the bank. Let us do the work for you.

Sign up for direct deposit TODAY to get your reimbursement faster. This service is FREE!

If I terminate employment can I still file a claim?

Yes, you can file claims for qualified expenses on services received prior to the date of termination through the run out of the plan year. Each plan run out period is different, check with your HR Team or Benefits Department for details.

If I choose not to enroll at initial enrollment, when can I enroll?

You can enroll during your open enrollment period next year, unless you have a change in family status.

Do I have to enroll in my employer’s health plan to participate?

No, enrollment in other group plans is not required to participate.

HRA Claim, Enrollment and Information Forms

Direct Deposit

Agreement

Agreement

Direct Deposit Agreement

General Claim

Form

Form

General Claim Form

Direct Deposit Enrollment Form

Direct Deposit Enrollment Form

FAQ – FSA with

Rollover

Rollover

FAQ - FSA with Rollover

Eligible Expenses

List

List

Eligible Expenses List

Mobile App

Information

Information

Mobile App Information

FSA Account Enrollment Form

FSA Account Enrollment Form

Website and Mobile App

Access Information

Access Information