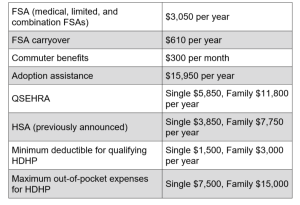

The IRS has announced an increase to the Healthcare FSA (FSA) contribution limits for

the 2023 plan year. The 2023 FSA contribution level maximum will be $3,050.

Healthcare FSA contribution limits work on a per-employee basis, so each spouse in a

household may contribute up to the new FSA limit for any plan year beginning on or

after January 1 st , 2023.

This change applies only to salary reduction contributions under a health care FSA; it

does not apply to employer-provided contributions, commonly referred to as flex credits.

Additional Tax Exclusion Changes

In addition to the Healthcare FSA limit change, the IRS also announced the following

adjustments for taxable year 2023:

– Transit and parking employee benefits: Monthly limit on transit and parking for

2023 was increased to $300 from the 2022 limit of $280.

–Adoption assistance programs: The maximum yearly exclusion for qualified

adoption expenses in 2023 will be $ $15,950, up from $14,890 for 2022.

– QSEHRA: The maximum reimbursement for a qualified small employer health

reimbursement arrangement (QSEHRA) for 2022 has been set to $5,850 for

individual coverage and $11,800 for family coverage. QSEHRA limits for 2022

were $5,450 for individual coverage and $11,050 for family coverage.

– FSA Carryover: The 2023 carryover is $610 per year, which is up $40 from 2022.

Changing FSA Contributions

Now that you know about the 2023 limit change, you may be asking “Can our

employees change their elections for our January renewal?”.

Keep in mind that the Healthcare FSA maximum for 2023 defined by the IRS tells

employers how much they can allow employees to contribute to an employer-sponsored

FSA – not what they must allow. If your benefits plan includes a Healthcare FSA,

employees should have the opportunity to enroll or re-enroll in the benefit during the

open enrollment period, in which case, yes, they can enroll in the Healthcare FSA for up

to $3,050.

If your election period has closed, you may reopen it for a window of time to allow

employees to change their elections if you wish to do so. Remember, all elections are

due to Pro-Flex by December 1 st to ensure Pro-Flex Benefit Cards are delivered by

January 1 st , 2023.

As a reminder, after the employee determines how much they wish to defer into the

FSA, these funds are available in full at the start of the plan year and are exempt from

federal income and employment taxes (as well as state taxes in most states). The

contribution amount elected should be deducted in equal amounts from the employee’s

pre-tax earnings each pay period, so be sure to notify your payroll provider of any

election changes as well.

After January 1 st , employees can only make contributions changes upon experiencing a

qualifying event like marriage, the birth of a child, divorce, or death of a loved one.

Additional Contribution Maximum

Information and FAQs

The 2023 contribution limit of $3,050 also applies to Limited Purpose FSAs (LPFSAs)

– the result of pairing an HSA with an FSA. As a reminder, a limited purpose FSAs can

only be used for qualifying dental and vision expenses until the medical plan deductible

is met, at which time it converts to a Healthcare FSA.

However, this new limit announcement does not apply to Dependent Care FSAs, which

has a limit that is defined separately. For Dependent Care FSAs, employees may

contribute up to $5,000 per year if they are married and filing a joint return, or if they are a single parent.

If they are married and filing separately, they may contribute up to$2,500 per year per parent.

How will rollover affect contribution limits? Carried over amounts do not count

towards contribution limits. In other words, employees may still elect to contribute up to

$3,050 in 2023 whether or not they roll over funds from 2022.

If employees choose not to elect an FSA in the 2023 plan year, will unused 2022

FSA funds still rollover? Yes, even if a member does not choose to contribute to an

FSA in the new plan year, up to $610 can rollover from the previous plan year if your

plan allows for the rollover of Healthcare FSA dollars.

Do we need to update our Plan Documents or SPD? No, provided that you use a

Plan Document and SPD that Pro-Flex generated for you. All Pro-Flex Plan Documents

and SPD’s include verbiage to account for IRS Adjustments. If you have a Wrap Doc, or

an SPD generated by a third party other than Pro-Flex, please contact your document

provider for additional details.

Do we need to opt-in to the increased limits? No. Pro-Flex will automatically opt-in

any client with a Healthcare FSA limit of $2,850 to the $3,050 limit unless you opt out in

writing. You will automatically opt-in to the new 2023 IRS limits for Adoption, Parking

and Transit as well, unless you opt-out in writing.

Do we need to allow employees to increase their elections if we have already

ended Open Enrollment for the January 1st renewal? No. Allowing employees to

increase their Healthcare FSA, Parking, Transit or Adoption limits are optional and can

be done at the employer’s discretion.

Have Additional Questions?

Please contact your Pro-Flex Benefits Administrator for further information. Don’t know

who your Benefits Administrator is? Simply call 716-633-2073 and we’ll point you in the

right direction.

Pro-Flex Administrators, LLC

8321 Main Street

Williamsville, NY 14221

www.proflextpa.com

Phone: (716) 633-2073